THE NEW BANK DEPOSIT OPPORTUNITY

TLA Scores

In 2018, a new period of opportunity begins for bank deposits.

There has been a confluence of two events:

1. Interest rates are rising, and

2. The stock market has become more volatile.

For nine long years, bank deposit interest rates were incredibly low.

But now, a number of banks have increased deposit rates to 1.45% or higher. The sums keep rising along with the rate boosts by the Federal Reserve Board.

So, finally, fixed-rate savings deposits and CDs are becoming attractive again – at the same time that the stock market is looking riskier. We expect billions of dollars to flow out of stocks and back into bank deposits.

Interest rates hit an historic low in 2009, as the Fed cut rates to near-zero to combat the Great Recession. By the millions, net savers turned to stocks (and especially high-dividend stocks) to replace the interest income they were losing.

But they weren’t all happy to do this. The stock market makes a lot of people nervous, and no financial advisors suggest that all of your cash ought to be in stocks.

Starting in 2018, there is a viable alternative in bank deposits. At least some of the money in stocks will flow back to banks, as has traditionally been true.

The History Of Rates And Time Deposits

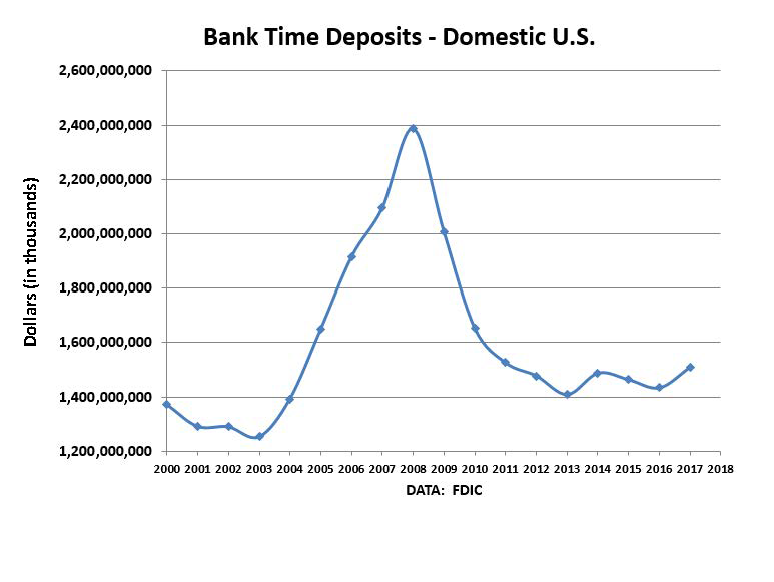

Time deposits offer the best measure of how bank deposits have fluctuated with interest rates over time.

From 2001 through 2003, when rates were falling, so did time deposits. Then, rates increased, and time deposits skyrocketed through 2008. But then, as rates plummeted in 2009, time deposits lost nearly half their value.

In the next chart, sourced from the FDIC, pay close attention to 2017. Time deposits began to rise again, and we believe that when 2018 data become available, we’ll see that this trend has gained much more speed.

Getting Your Share – And More

Traditional bank marketing of deposits has not exactly been rocket science. We all remember the toasters handed out for each new savings account.

More recently, we’ve seen some other incentives. JP Morgan Chase has repeatedly offered a $300 bonus for deposits under some circumstances. But JPM has made this offer without much targeting, sometimes to “resident” at a particular mailing address.

Any bank seeking to get a large share of the new deposit money ought to target consumers who have the most to invest. But how do you find the wealthiest people?

One way is to use estimated household incomes, and nearly every demographics vendor has some estimate. This seems sensible at first glance, but incomes and savings do not always correlate very well.

Young professionals may have high incomes, but not much savings. Older consumers are more likely to have the savings accumulated over a long career, even if they are now on fixed incomes.

The TLA Score: Total Liquid Assets

SMR offers something more precise: a score designed to rank-order homeowner households by their total liquid assets (cash, marketable securities, and IRAs).

We call it the TLA Score.

We create the scoring algorithms from government survey data used to help support the monthly Consumer Price Index. This survey contains actual and verified liquid assets measures – and also contains details on home structures, home ownership, home values, mortgage loans, and home equity loans.

The survey data are anonymous. But the correlations we see in the survey data allow us to create algorithms we then apply to our database of virtually all U.S. homeowners.

We create a TLA score for each of more than 60 million homeowners, updated monthly.

We set the national average liquid assets amount to a score of 100. Any score above 100 means higher-than-normal cash, and any score below 100 means less. Scores can range into the thousands – because in the U.S., there are some very wealthy households.

Since we have the names and addresses of these homeowners, those with high TLA scores represent a great mailing list almost certain to yield larger-than-average savings and CD accounts.

The same scores are ideal for other uses: life insurance marketing, securities marketing, and marketing of all high-end consumer products and services.

________________________________

To learn more about the TLA Score, give us a call at 908-852-6809